Appointing the Public Trustee to execute the estate

Trust fees are not clearly communicated, fees are not proportionate to actual work involved and failure to meet its administration timelines.

The Office of the Auditor General's findings make for an interesting and enlightening read when considering allowing the Court to appoint the Public Trustee in your replace. You would assume it being a government department that it would operate to a certain standard and be priced fairly without profit.

The full report is available via the link inset, below which I've lifted some of the more salient findings from their report.

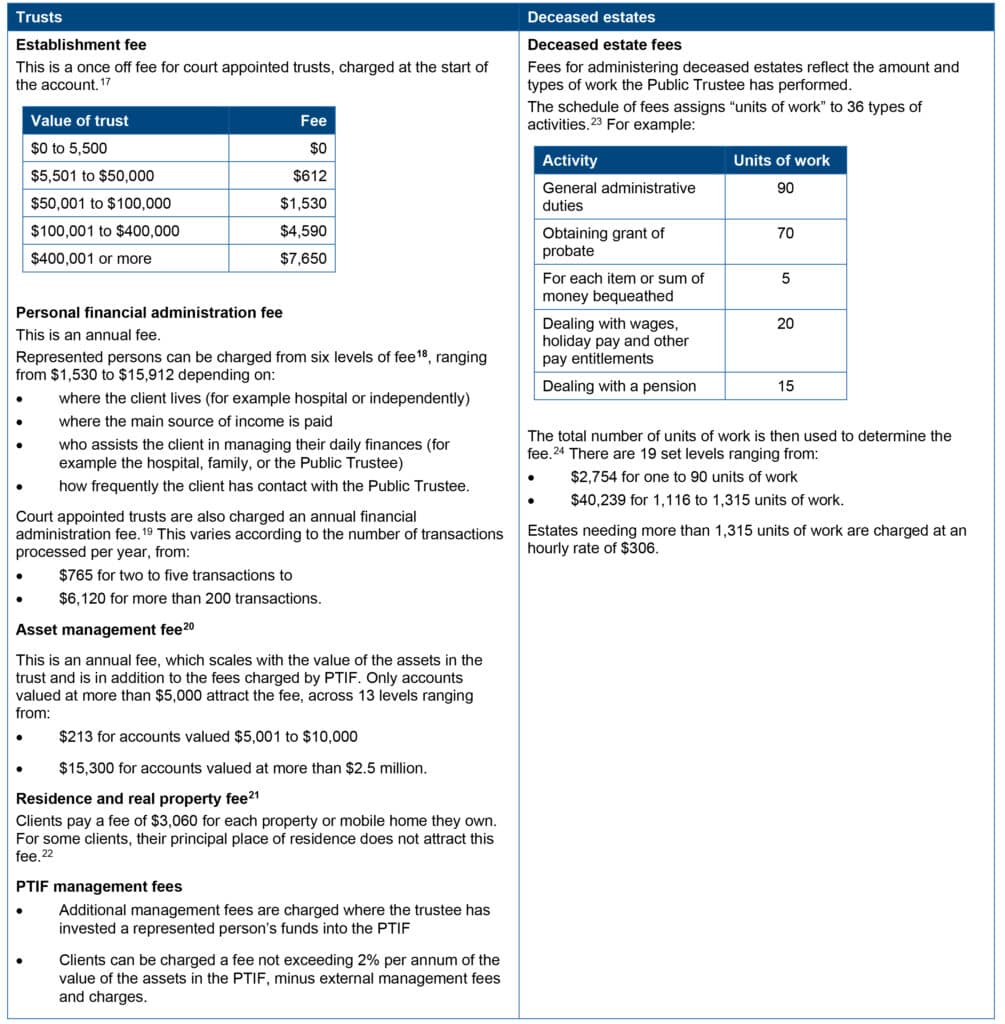

Trust fees did not always reflect actual work effort and were not effectively communicated to clients

The Public Trustee charges its trust clients in line with its schedule of fees. We reviewed 40 trusts and found clients were charged in line with the schedule of published fees. Generally, we were able to confirm that the fees charged reasonably reflected the work done.

Scheduled fees can exceed actual work effort

However, in some cases the full scheduled fee had been charged where the actual work done was minimal or automated. We noted this happened when charging the establishment and asset management fees on trusts with higher asset values, primarily because these fees scale with the total value of the trust. That is, larger trusts automatically attract considerable charges. While some clients’ needs might be complex and need additional work, this is not always the case (Case study 1). It is possible for clients to incur considerable fees for relatively little work by the Public Trustee on their trusts.

Trust managers consider adjusting a client’s fees if a complaint or request to do so is received. This approach can place considerable responsibility on its vulnerable clients, their guardians and carers, and requires them to understand when charges may not be appropriate. The Public Trustee told us its current approach is necessary given its high case load and staffing issues, and that managers have also on occasion requested adjustments for clients who have not complained.

The Public Trustee does not charge full fees to trust clients without financial means and very low balances, regardless of the work performed. It automatically applies a rebate to these accounts when the fees are more than 5% of their total asset value or if fees would reduce the account to less than $5,000 in cash. In 2020-21, about 4,500 (64%) of trust clients received a rebate. While these clients do not pay the full fee, they still pay at least $35 per month. As a self-funded (rather than appropriation-funded) entity, the cost of these rebates is effectively covered by the fees charged to those clients that can afford to pay.

In 2020, the Public Trustee engaged an external reviewer to assess the appropriateness of its approved fees in comparison with public trustees in other jurisdictions and private trustees. The review found the regime was fair, reasonable, and appropriate in most instances. During our audit, the Public Trustee advised it would further review its fees to determine how they could be improved and simplified.

Trust fees are not clearly communicated to clients

Trust clients are not provided with a clear and easy to understand explanation of the fees that are more likely to be charged to their account. Clients are given a high-level overview, but this does not include amounts. They are then directed to the schedule of fees on the Public Trustee’s website. However, we found clients are unlikely to easily understand the schedule, as it is written in formal and complex language, with potential fees spread throughout. Clients may benefit, and better understand the risks to their finances, if fees are presented to them in a simplified and guided way, as private trustees are obliged to do.

Additionally, trust clients are not regularly told what fees they have been charged and why. The Public Trustee provides clients, or their guardians, with a financial statement if requested, when the account is closed or as required by a SAT order. This reflects the Public Trustee’s concern that financial statements in the wrong hands increase the risk of clients being financially exploited. However, not all clients face this risk, and the approach reduces transparency of charges for all trust clients. Some clients remain with the Public Trustee for long periods, during which they may not know what funds they have or the fees they have paid.

The Public Trustee charged deceased estates in line with the fee schedule, but did not meet its administration timelines

We reviewed 39 deceased estate files and found clients were charged in line with the schedule of fees. The Public Trustee communicated its deceased estate fees well, provided clients with clear explanations, and where possible, quoted on likely fees.

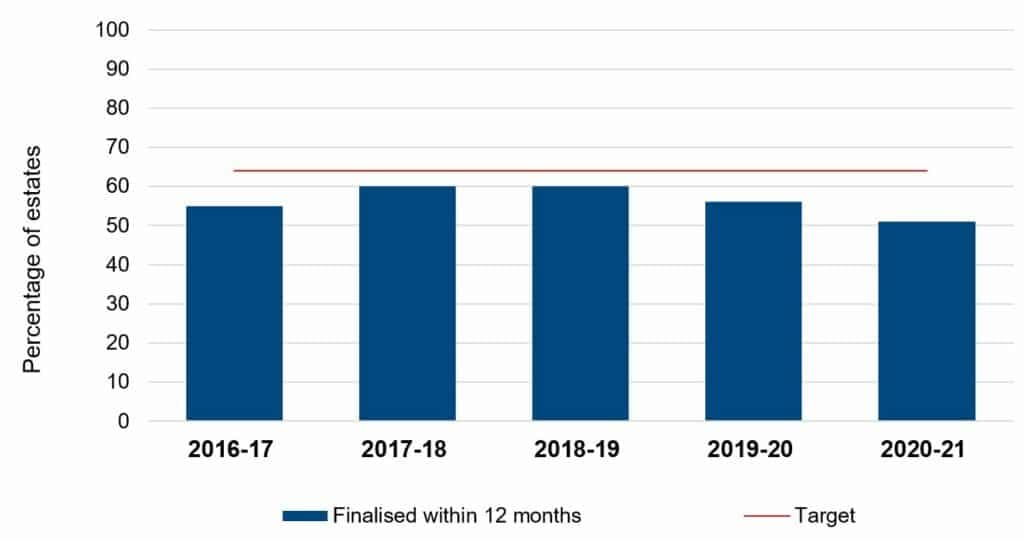

However, the Public Trustee has failed to meet its own target timeframe for finalising deceased estates. It has an annually audited key performance indicator (KPI) of the percentage of estates finalised within 12 months, with a target of 64%. Over the past five years the Public Trustee has publicly reported:

- it has not met the target with the percentage of estates completed having fallen from 55% in 2016-17 to 51% in 2020-21

- the average time taken to finalise an estate has risen from 7.1 to 7.4 months (Figure 1).

This means beneficiaries are waiting longer for proceeds to be distributed to them.

The Public Trustee’s 2020-21 Annual Report14 attributed the decreased performance to COVID-19 and the subsequent delays in dealings with financial institutions, overseas services, government offices and property sales.

Other timeframes for key activities in the administration of deceased estates were also not met. The Public Trustee has target timeframes for four activities. We found delays in three. Some delays were beyond the Public Trustee’s control, for example, delays in receiving death certificates.

| Activity | Target timeframe | Target timeframe15 | Number and percentage of files where the timeframe was not met |

|---|---|---|---|

| Opening the file | 7 days from the date activity is initiated | 38 | 3 (8%) |

| Instruction sent to prepare authority application | 28 days from the date activity is initiated | 36 | 7 (19%) |

| Acting on authority | 28 days from the date the authority is collected | 36 | 0 (0%) |

| Referred for distribution | 56 days from when the authority is collected or 14 days from when realty has been disposed | 33 | 1 (3%) |

Response from the Public Trustee

The Public Trustee welcomed the opportunity for an external review by the Auditor General to “examine whether deceased estates and trusts are administered effectively and whether effective controls are in place to prevent fraud”.

It is comforting to read that the Auditor General found that the Public Trustee understands its high-level risks, has a coordinated approach to manage them and has a detailed fraud and corruption control plan in place.

It is particularly pleasing to note that the Auditor General, after conducting exhaustive data analytics of three years of financial transactions, found no evidence of fraud or corruption.

Prior to the audit by the Auditor General, the Public Trustee had commissioned an external review by a leading independent economics and public policy firm to undertake a review of its fees and charges. The review in July 2020, found the Public Trustee’s current work effort fee regime is fair, reasonable, and appropriate in most instances.

The Public Trustee has further engaged the independent consultancy, to undertake an investigation into stream-lined and simplified trust and deceased estate fees.

The Public Trustee believes its clients receive a quality service at an affordable price.

The Public Trustee will fully co-operate with any planned review by the Department of Treasury to assess the appropriateness of its self-funding model and related governance arrangements.

The Public Trustee believes it offers its clients fees and charges transparency. It provides clients with financial statements if requested when an account is closed or when required by a Tribunal Order. It is reluctant to provide regular financial statements to some clients, based on a risk concern that these vulnerable clients maybe exploited.

The Public Trustee welcomed the decision by Government in the 2022/23 State Budget to enable our office to significantly increase staff numbers to address the escalating demand for administration services from people with decision-making disabilities.

It was the largest staffing increase in the history of the agency and will see staff numbers increase by more than 10%.

The Auditor General’s report acknowledged that the Public Trustee has already addressed the findings related to the need for better supplier master file controls, including concerns raised about supplier duplicates, and has strengthened controls associated with cash cards.

Recognising the findings raised in the report, the Public Trustee remains fully committed to a program of continuous improvement to deliver effective and efficient services to its diverse range of clients.

The Public Trustee accepts the Auditor General’s Report recommendations which, once implemented, will further improve its business operations and processes for the benefit of its clients.

Comment in response from the Auditor General

I am concerned that paragraph three of the Public Trustee’s response overstates the extent of data analytics work performed during the audit and infers an audit conclusion that provides a level of assurance about fraud or corruption beyond the scope of this audit.

My Office’s work was limited to that stated in this report, including examining a sample of case files for fee calculations in accordance with gazetted (approved) fees. On this aspect, we examined only 79 files (40 trusts, 39 deceased estates) of approximately 8,000 that are open during the year.

Given this organisation represents an inherently high fraud risk operating environment, the audit also included an examination, on a sample basis, of the Public Trustee’s controls for the prevention, detection and response to fraud and corruption. It is important that control weaknesses identified during the audit are promptly addressed, and ongoing vigilance maintained.

No audit can ever provide absolute assurance, as our procedures do not examine and re-perform every transaction. As stated on page 7, my Office’s audit scrutiny of the Public Trustee’s operations is ongoing.